Stay safe online – learn to recognise these common scams

According to cybersecurity firm Kaspersky, phishing is on the increase. The company reports a spike in activity recently, coinciding with tax season.

Fraudsters are increasingly sophisticated, even using AI to drive phishing attacks and develop malware. It can be difficult for older people, especially, to differentiate between genuine calls, emails and websites, and those generated by scam artists.

Read on for tips on how to recognise scams and avoid becoming a victim.

What is ‘phishing’?

The term covers any activity used to trick individuals into revealing sensitive information, through fraudulent emails, phone calls, websites, or text messages.

One of the most common scams involves a phone call from someone claiming to work in the fraud department of your bank. These callers are extremely plausible. Often they have your ID number or address, and use these details to convince you of their legitimacy.

They warn of ‘unusual activity’ in your bank account or urgent ‘security threats’. Or they ask you to confirm a large transfer out of your account. These tactics provoke panic and hasty action on the part of the victim.

The bank security threat scam

Victims are tricked into disclosing card details and passwords, authorising OTPs, or transferring funds to scam accounts.

Be especially careful the day before a public holiday when banks close, making it more difficult to query unauthorised activity on your account. Fraudsters know this and target these days.

Some brazen con artists have even visited older people in their homes, claiming to be police officers investigating fraud, or bank employees sent to help them renew ATM cards.

They trick you into handing over the ‘expired’ card, along with your PIN number. Then off they go to the nearest ATM to clean out your account!

The Tax rebate scam

Watch out for fake calls or emails from ‘SARS’ advising you that you are due to receive a refund. All you need to do is verify your bank details …

Or you get an email with an attachment that looks like the login screen of the SARS e-filing website. Except, it is nothing more than a clever fake designed to trick you into providing your login details.

The NaTIS scam

Who wouldn’t be taken in by an email from ‘NaTIS’ advising you that you have an outstanding traffic fine?

Pay it immediately, the email says, to avoid prosecution. But when you click the link, it takes you to a fake website and your payment goes straight into the scammer’s bank account.

Cloning of number plates

If you have genuine traffic fines, make sure it’s your vehicle and not someone else’s sporting your number plate.

According to nationwide statistics, one in five number plates are cloned, leading to traffic fines being issued to blameless victims. Unfortunately, the onus is on you to prove that you didn’t break the law.

Be on your guard when using ATMs. Wherever possible, use one that’s inside the bank.

ATM and pension payout fraud

ATM fraud isn’t new, but it’s enduring – and criminals are becoming increasingly slick. They’re often well dressed, friendly and articulate and work in groups to steal your card and PIN.

One person distracts you while another swaps your card with one of their own. A third stands close enough behind you to watch you key in your PIN. Or they may offer help and skim your card using a device.

Older people in particular are more likely to ask the person behind them in the queue for help – which can be devastating if they ask the wrong person. Elders also tend to be more helpful themselves, and can be tricked into ‘helping’ someone else in the queue. Only afterwards do they realise their card has been swapped or cloned.

Scams Targeting the Elderly

Older people may be more easily fooled because they aren’t aware of the tactics used by fraudsters. Or they don’t fully understand banking apps.

They tend to believe calls really are from their bank … or that a loved one has been arrested and bail must be paid immediately to avoid them being jailed.

One elderly man described receiving a call from a ‘customs officer ‘who knew his name, ID number and email address – apparently from a data leak. He was told that a parcel containing drugs and addressed to him had been intercepted, and that he would be arrested by the police unless he allowed the caller to ‘help’ him sort it out.

These threats are particularly frightening when you are older and less familiar with the tactics.

How to protect yourself

- End unsolicited calls and contact the official customer support number to confirm what you’ve been told. Or login to your bank app to check for unauthorised activity.

- Don’t allow yourself to be frightened into disclosing sensitive information. There are safeguards on your card or bank app, such as OTPs that are designed to protect you. If you are worried, end the call and discuss it with a trusted friend or family member.

- Check OTP messages carefully to make sure that they relate to activity you’ve authorised.

- Keep abreast of the latest tax scams reported by the banks and SARS.

- Never login via a link in an email or SMS. Type the official SARS or bank website URL into your browser.

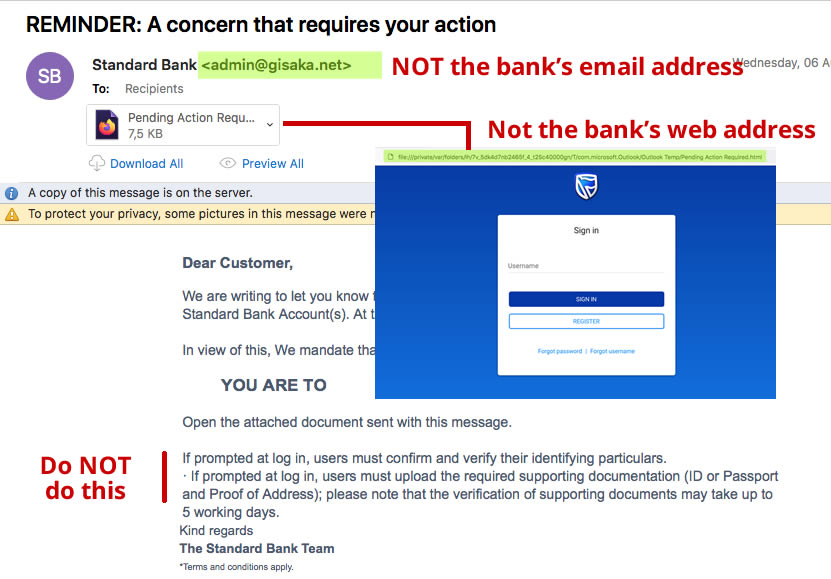

This email scam is easy to spot when you know what to look for.

- Avoid opening email attachments ending in .htm or .html, which are fake web login pages.

- If you are urged to pay a traffic fine, check the NaTIS website or Check Fines to make sure the fine is genuine.

- Don’t leave older family members alone in malls and pension payout queues, where opportunistic criminals abound. Make sure they are accompanied by a younger family member or a trusted friend.

- Warn older family and friends against ‘helping’ a stranger who asks them for assistance. They should rather refer the person to bank staff or security.

- Never accept help from a member of the public at an ATM. Be alert to your surroundings and don’t use the ATM if there are suspicious people around. Make sure you screen the keypad from prying eyes when entering your PIN.

- Educate yourself – banks never ask for credentials via email, SMS, or unsolicited calls. Nor do they send representatives to your home to help you renew expired cards.

- Don’t share OTP codes sent to your phone – legitimate organisations will never request they be read over the phone.

- Use strong passwords and 2-factor authentication if it is available.

Being aware of current scams, and being careful not to divulge card details or OTPs to anyone, can help you thwart the most plausible fraudsters. Stay safe!

Simple home safety tips that protect independence

Simple home safety tips that protect independence Affordable accommodation for life

Affordable accommodation for life Stay safe online – learn to recognise these common scams

Stay safe online – learn to recognise these common scams Community support for Mandela Day was inspiring

Community support for Mandela Day was inspiring Tafta proud to be placed in the Top 3 for the KZN Top Brand Awards

Tafta proud to be placed in the Top 3 for the KZN Top Brand Awards Puzzling it out – brain-boosting fun for older adults

Puzzling it out – brain-boosting fun for older adults Tafta Council member awarded MBE

Tafta Council member awarded MBE Concern and confusion over SASSA Old Age Grant payments

Concern and confusion over SASSA Old Age Grant payments Communication through the ages – we’ve come a long way!

Communication through the ages – we’ve come a long way! Vote for us in the KZN Top Brand Award

Vote for us in the KZN Top Brand Award